Delivery Companies Sued for Excessive Restaurant Fees

New York customers are suing DoorDash, GrubHub, UberEats and Postmates for “exorbitant fees” that range from 13% to 40% of food orders, and for anti-competitive practices that discourage restaurant owners from incentivizing direct orders and “limit consumer choice.” A typical restaurant’s profit margin is less than 10% of revenue, making delivery fees punishingly expensive. The plaintiffs filed with a Manhattan court on Monday and seek class-action status.

According to the complaint, delivery giants push restaurant owners to charge higher prices through anti-competitive contracts. These contracts require owners to charge the same prices to all customers, whether they dine-in, carry out, or order through third-party delivery services. This leads to a rise in the number of orders placed through convenient delivery apps with large marketing budgets, even though the restaurant would otherwise encourage direct orders with cheaper prices. Third-party couriers charge restaurants 10% to 40% on the value of the orders that they initiate, which is a crushing cost for most restaurants who struggle to maintain a typical 10% profit margin.

The complaint summarizes the problem: “In exchange for permission to participate in defendants’ meal delivery monopolies, restaurants must charge supra-competitive prices to consumers who do not buy their meals through the delivery apps, ultimately driving those consumers to defendants’ platforms.”

DoorDash, GrubHub, UberEats and Postmates promise that the price they charge to consumers is what the restaurants actually charge. This covenant prevents the restaurants from charging a lesser amount to people who dine-in or order directly.

The plaintiffs allege that restaurants do not have a meaningful choice to opt-out due to the large customer base on these apps. Well-capitalized delivery giants create a monopoly-like situation by capturing a controlling share of the market. Restaurant owners could offer consumers lower prices for direct orders, but contracts with delivery companies prohibit this practice.

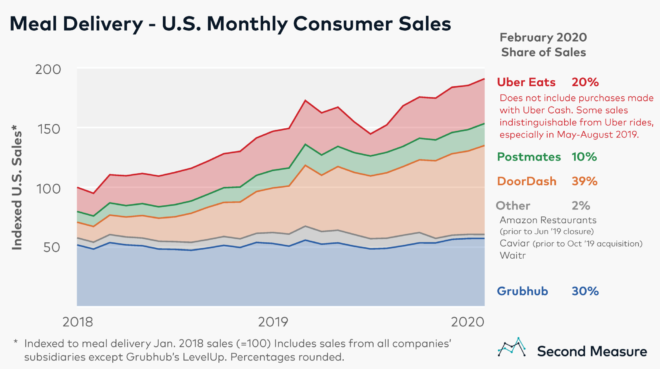

Market Share of Food Delivery Apps

(Source: Second Measure)

Ranked by estimated sales as of February 2020, the four largest meal delivery services in the U.S. are DoorDash (39%), GrubHub (30%), UberEats (20%) and Postmates (10%). DoorDash’s subsidiaries include Caviar and Mercato; GrubHub’s subsidiaries include Eat24, Seamless, LevelUp, and Tapingo; UberEats’ subsidiaries include Ando and Cornershop. PostMates’ revenue includes its share of Whole Foods deliveries ex-Amazon.)

According to Second Measure, in New York City, Grubhub controls 66% of market share as of February 2020. Similarly, other apps own dominant shares in different regions. For example, DoorDash controls roughly 65% of San Francisco and 54% of Dallas-Fort Worth.

With the spread of COVID-19, food food delivery is the most suitable option for many self-quarantined. Indeed, delivery apps are “essential services” according to various state governments (see for example Massachusetts, Washington and Kentucky). With no ability to dine-in or transport themselves to restaurants, delivery apps have become a necessity for consumers, imbuing the couriers with even more power over restaurant owners.

In San Francisco, one day after the the lawsuit was announced, a company called No App Needed announced, “Due to current events, No App Needed will be completely free for all businesses for the next 6 months from April 1st, 2020 until September 30th, 2020.” The company does not require an app or nor account creation for restaurant owners nor consumers.

The lawsuit is entitled Davitashvili v GrubHub Inc. filed in the U.S. District Court, Southern District of New York.

Photo by Bill Oxford on Unsplash

Leave a Reply