McDonald’s Earnings Disappoint, Starbucks Beats

It is earnings week; more blue chip companies report second quarter fiscal results this week than any other week. Today on national radio, senior restaurant analyst Michael Halen discussed disappointing earnings reports from McDonald’s (NYSE:MCD) and Starbucks (NASDAQ:SBUX).

McDonald’s reported earnings per share $0.10 per share below analysts’ consensus for another consecutive quarter. The company also disappointed in its U.S. comparable store sales. Although analysts had anticipated negative results due to the coronavirus pandemic, they were hopeful that drive-thru sales would have better compensated for the loss of dining room sales; 95% of McDonald’s have drive-thru windows.

Michael Halen discussed the report as follows. “McDonald’s kind of underperformed a little bit early on in the pandemic. I think part of that was the fact that they halted their all-day breakfast to kind of help to improve franchisee margins and throughput at the drive-thru during lunch and dinner times. But they’ve been able to increase their same-store sales in July. They outperformed their QSR [Quick Service Restaurants] competitors in May and June, which we knew were going to be weak anyway. So it looks like, when it comes to sales, they’re back in a mode of taking market share again here in the U.S. which we’ve been kind of accustomed to over the past few years.”

Halen highlights an important accounting technique that other restaurants have utilized to try to artificially inflate their comparable store sales. “Some markets were shut down completely — France, U.K., Spain, Italy — those were four markets that were completely closed for part of the quarter. McDonald’s does the right thing by including store closures in its same-store sales estimates. So some of the restaurant peers we’re going to see reporting, their numbers might look a little better, but that’s because they leave closed doors out of the comp base.”

McDonald’s closed the trading day -2.4% lower after its earnings report. What is Halen’s forecast after today’s numbers? “All told, what you see out of McDonald’s is that they’re recovering, and they’re recovering a little faster than many of their peers because there’s a strong drive-thru business. Store sales are getting back to growth, you know; [profit] margins, however, are a bit of a different story… Even though they only have 2,000 dining rooms open, the fact that they’re able to generate positive same-store sales is a good sign.”

Halen finished with some final notes on McDonald’s international locations. “International, a little bit different. So those four markets that I mentioned in Europe, that had been closed down, they do maybe 30% of their sales at the drive-thru. So that’s going to be a big headwind. China also seems to be, consumers continue to be scared of coronavirus, and it’s affecting their consumption behavior. There are very few drive-throughs in that country. So, they also pointed out that in China, they expect sluggish sales to continue through the year.”

Starbucks

Starbucks reported a loss of $-0.46 per share excluding non-recurring items, $0.11 better than Wall Street’s consensus of $-0.57. Revenues fell 38% versus the same period last quarter to $4.2 billion. Analysts had estimated $4.1 billion.

Starbucks issued upside guidance for the 2020 fiscal year, guiding earnings per share of $0.83-0.98 excluding non-recurring items, versus the $0.77 Wall Street estimate and prior guidance of $0.55-0.95. Investors were generally happy with the report, with Starbucks is trading 5.6% higher today in after-hours trading.

Halen shared his thoughts, “Starbucks, you know, much bigger issues than McDonald’s. And I think at the end, it will take a lot longer for their sales to recover.” Indeed, Starbucks has declined 13% this year, whereas McDonald’s valuation is unchanged.

Halen continued discussing Starbucks, “Only about 30% of their U.S. stores have a drive-thru. So that’s problematic. Also, breakfast sales have been hit the hardest in the QSR [Quick Service Restaurants] industry, because of increased telecommuting, less people going to work. So that’s obviously going to be very impactful for Starbucks. They do a big business and there’s a lot of people in the stores, and you have consumers that still aren’t ready to get back to packed cafes. So, for all of those reasons, we expect sales to be down much, much more in the quarter, maybe down about 40%.”

Halen continued, “For Starbucks, they also have much more margin pressure, because they own and operate about 50% of their stores. Whereas, you know, McDonald’s is about 6%. So they’re going to have much higher pressure on the [profit] margin side.”

Full Service Restaurants

Halen switched his analysis to the sit-down restaurant industry, speaking more generally. “Some of these full service dining chains are starting to do better, because I think there were stimulus checks, right? There were increased payments in unemployment. People definitely had a lot of cabin fever… As we move into the fall and the winter and outdoor dining goes away in many of the states in the United States, we expect there to be continued pressure on the full service sector. Right now, delivery continues to be the place to be, with drive-thru a close second. Interesting, interesting times in the restaurant business. One of the hardest hit sectors, still feeling the pain.”

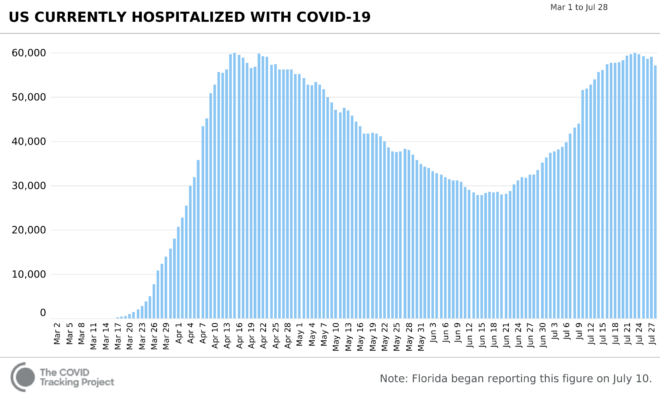

Total U.S. COVID-19 deaths now total 147,672, including 1,126 new deaths today. Total cases of the disease exceed 4.2 billion, including 54,448 cases confirmed since yesterday. There are currently 57,091 patients hospitalized for the disease.

Graphic by The COVID Tracking Project at The Atlantic (CC BY-NC-4.0); Photo by Thabang Mokoena on Unsplash

Leave a Reply