Restaurant Tenants Renegotiate Rent and Mortgages

A new report confirms what many already knew: mortgage delinquencies are hitting record highs. To be specific, 6.1% of total U.S. mortgage borrowers are delinquent on payments — their worst rate since January 2016. Not included are an additional 8% of mortgages now in forbearance. For retail borrowers like restaurateurs, delinquencies hit an all-time high of 18% in June and could be as bad as 69%, depending on location.

The national 6.1% delinquency rate includes both commercial and residential mortgages, and the commercial subset is performing the worst by far. Unpaid U.S. retail commercial mortgages tripled from 3.67% in April to over 10% in May.

Analysts had predicted even worse numbers going forward, and a staggering retail mortgage delinquency rate of 18% in June confirmed that dire forecast. The only industry with a higher delinquency rate in June was lodging at 24%, an aberrant 14 times higher than February’s 1.6% rate. In comparison, delinquencies on mortgages for retail establishments have modestly [sic] quintupled since February.

For restaurant owners, however, the situation is creating an unprecedented opportunity to renegotiate rent. From March through June, the food service industry has laid off 3,130,900 workers — “the most of any industry and nearly double the figure from the next-most-affected industry,” according to U.S. Representative Brian Fitzpatrick.

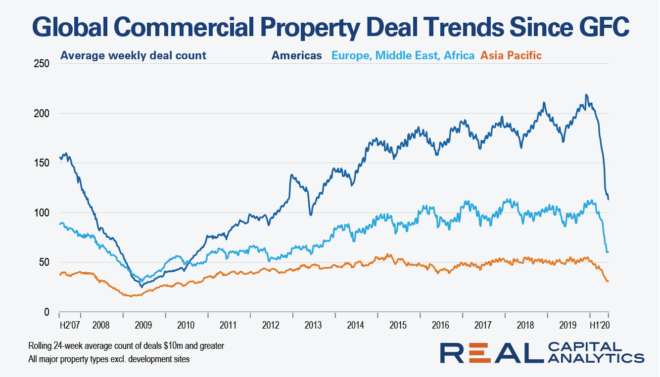

For any restaurateurs who have not renegotiated with their landlords, the time to do so is now. Commercial real estate deals fell 79% in May compared to May 2019, with the rate of transactions the lowest since 2010. Retail property closings fell 83% in May. Average property deals of all types for the first six months of 2020 have halved.

The U.S. Bankruptcy Court in Illinois published a ruling on June 3 that a force majeure (“Act of God”) provision in a restaurant lease partially excuses tenants’ obligation to pay rent during the COVID-19 pandemic. The tenant in this case was Hitz Restaurant Group, operator of several bars and restaurants in Chicago. The ruling sets precedent for restaurateurs in other states.

The rent and mortgage non-payment rate is even worse when considering that today’s delinquencies are occurring in spite of the largest fiscal stimulus in U.S. history. Congress has allocated $2.6 trillion within three months. That amount exceeds the Great Recession’s $1.8 trillion recovery stimulus, which was allocated over five years starting in 2008.

Although many restaurant owners received aid from the Paycheck Protection Program (PPP), most have exhausted those funds. A new report from Goldman Sachs suggests that 84% of PPP recipients will exhaust their funds by the first week of August. Our analysis shows that the PPP was helpful but far from adequate to support restaurant owners. Trade associations are lobbying for an additional $120 billion of dedicated stimulus package for restaurateurs, the Restaurants Act of 2020.

Below is a chart of commercial property closings since the Great Financial Crisis (GFC) of 2008 through present day. It demonstrates that commercial property closings for the first half of 2020 have halved.

Source: Real Capital Analytics. Photo by Peter Bond on Unsplash.

Leave a Reply